Minnesota: MNsure wraps up 2026 Open Enrollment w/139K QHPs, down 8.1% y/y; 50% increase in cancellations, 112% increase in "buying down"

MNsure, Minnesota's state-based ACA exchange, has posted their January Board Directors Meeting presentation, which includes the final 2026 Open Enrollment Period tally along with a bunch of other data points of interest:

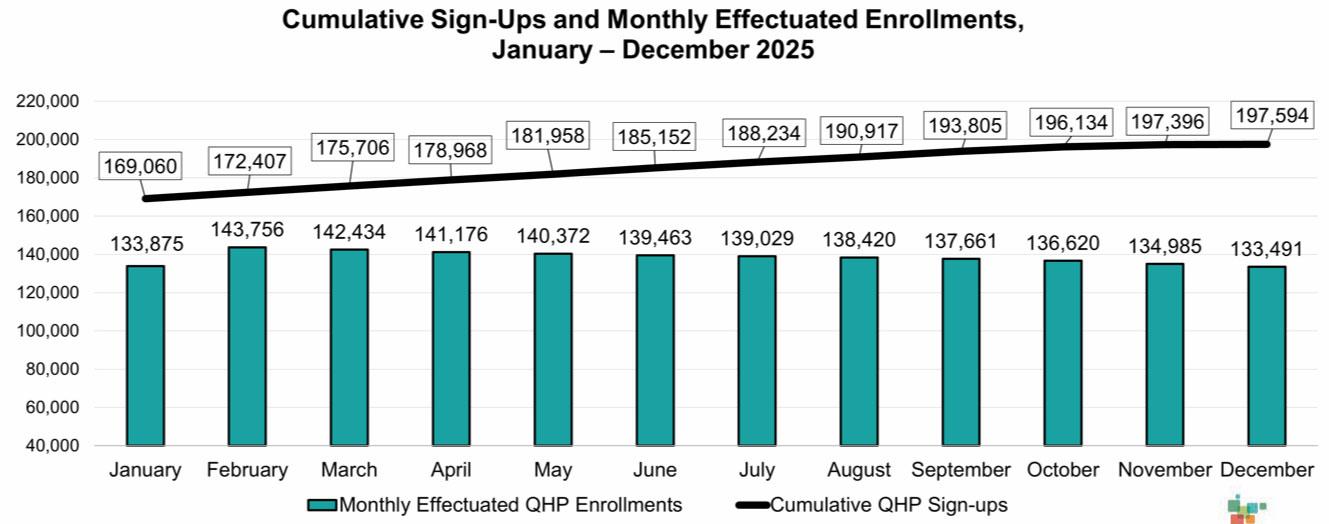

Plan Year 2025 (November 1, 2024 – December 31, 2025)

- Total (Medical Assistance, MinnesotaCare, QHP) 357,227

- Medical Assistance Applicants 141,897

- MinnesotaCare Applicants 17,736

- Qualified Health Plan (QHP) Sign-ups 197,594

- QHP New Consumers 74,423

- Qualified Dental Plan Sign-ups 59,575

Financial Assistance Type Individuals

- Percentage with Advanced Premium Tax Credit (APTC): 62.3%

- Percentage with Cost-Sharing Reductions: 9.6%

- December Average Monthly APTC: $360.15

- Cumulative APTC for Households Receiving APTC: $376,892,297

The reason Minnesota has such a small percent of their ACA exchange enrollees receiving either APTC (over 92% nationally last year) or CSR assistance (over 50% nationally) is because of MinnesotaCare, their Basic Health Plan program for residents who earn between 138 - 200% of the Federal Poverty Level (FPL).

This also means that Minnesota's trendlines/demographics can't really be applied to the country at large, since 65% of all ACA enrollees nationally earn less than 200% FPL.

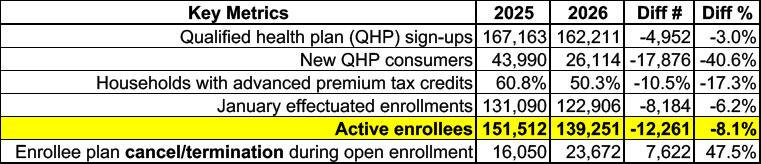

Plan Year 2026 (November 1, 2025 – January 15, 2026)

- Total (Medical Assistance, MinnesotaCare, QHP) 201,268

- Medical Assistance Applicants 32,063

- MinnesotaCare Applicants 6,994

- Qualified Health Plan (QHP) Sign-ups 162,211

- QHP New Consumers 26,114

- Qualified Dental Plan Sign-ups 50,736

Financial Assistance Type Individuals Households

- Percentage with Advanced Premium Tax Credit (APTC) 49.5%

- Percentage with Cost-Sharing Reductions 8.5%

- Average Monthly APTC $391.32

- Estimated January APTC for Households Receiving APTC: $25,435,059

- 87% increase in number of enrollees who switched plans

- 52% of enrollees kept their metal level (bronze, silver, gold)

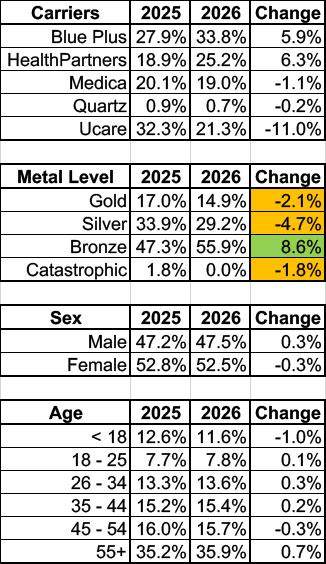

- 112% increase in consumers “buying down”

- 15% of enrollees canceled or terminated their coverage during OEP (up from 10% last year)

Older enrollees (age 55+) made the most changes:

- 21% changed plans

- 80% of enrollees who changed, went with a lower premium plan

- Younger enrollees (ages 18 – 34) had highest rates of disenrollment

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.