How much more will IDAHO residents pay if the improved #ACA subsidies expire? (updated)

Originally posted 12/18/24

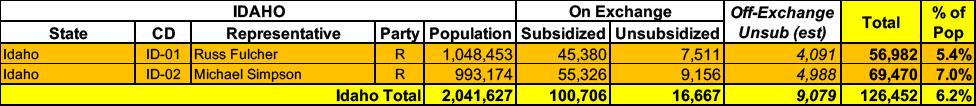

Idaho has around 117,000 residents enrolled in ACA exchange plans, 86% of whom are currently subsidized. I estimate they also have another ~9,000 unsubsidized off-exchange enrollees, although the actual rate filings (summarized later in this post) put the off-exchange total at a much higher ~47,000.

Combined, that's 6.2 - 8.0% of their total population.

Assuming the national average 6.6% net enrollment attrition rate thru April reported by the Centers for Medicare & Medicaid Services applies to Idaho, however, that would knock the current enrollment down to more like 118,000 statewide.

In early 2021, Congressional Democrats & President Biden passed the American Rescue Plan Act (ARPA), which dramatically expanded & enhanced the original premium subsidy formula of the Affordable Care Act, finally bringing the financial aid sliding income scale up to the level it should have been in the first place over a decade earlier. They then extended the subsidy upgrade out by another 3 years via the Inflation Reduction Act.

In addition to beefing up the subsidies along the entire 100 - 400% Federal Poverty Level (FPL) income scale, the upgrade eliminated the much-maligned "Subsidy Cliff" at 400% FPL, wherein a household earning even $1 more than that had all premium subsidies cut off immediately, requiring middle-class families to pay full price for individual market health insurance policies.

Unfortunately, the improved subsidies are currently scheduled to end effective December 31, 2025. Needless to say, with Republicans holding a trifecta, it's highly unlikely that the IRA's enhanced subsidies are going to be be extended further. They had the opportunity to do so as part of H.R. 1 (the so-called “Big Beautiful Bill”), but chose not to.

It gets worse:

In addition, the so-called “Affordability & Integrity Rule” put into place by RFK Jr., & Dr. Oz at the Centers for Medicare & Medicaid Services (CMS) is causing 2026 subsidies to be even less generous and gross premiums to increase even more.

In Idaho specifically, all of this will result in average gross premiums hikes of 10.5%.

I decided to run the numbers myself to get an idea of just how much the combination of expiring IRA subsidies and the CMS "Affordability/Integrity Rule" will cause net premiums to increase starting in January 2026.

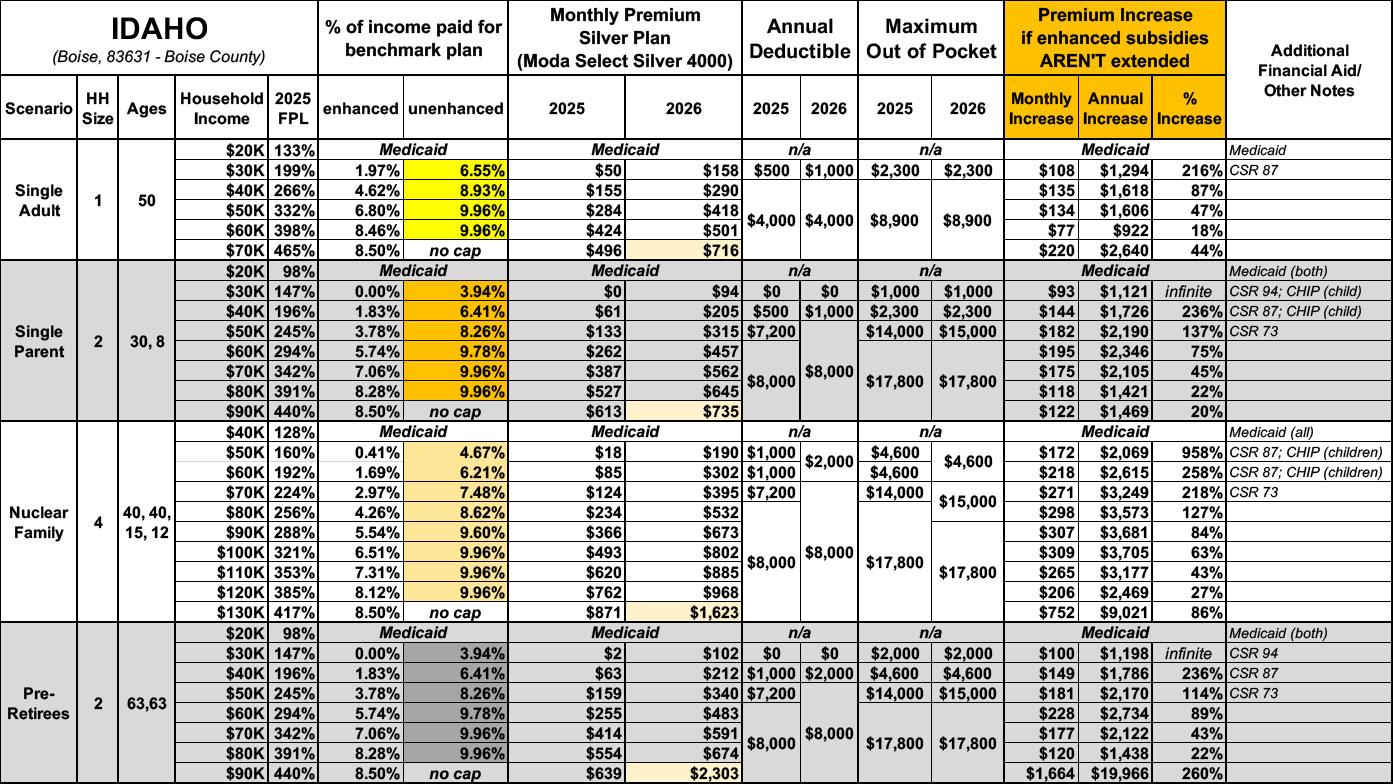

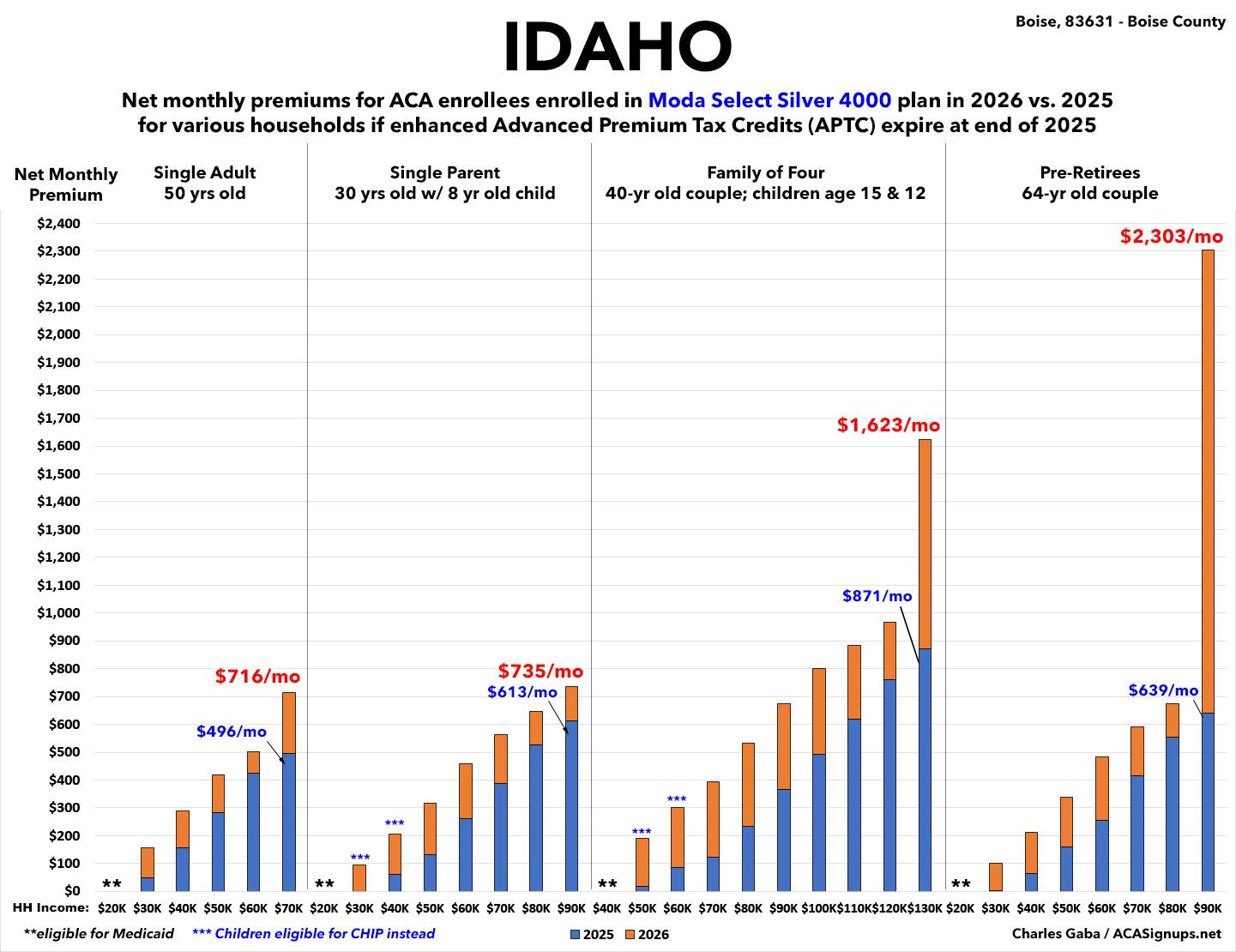

I'm using four household scenarios, at several different income levels for each:

- a 50-yr old single adult earning between $20K - $70K/year

- a 30-yr old single parent w/an 8-yr old child, earning between $20K - $90K/year

- a 40-yr old couple w/2 children age 15 & 12, earning between $40K - $130K/year

- a 64-yr old couple earning between $20K - $90K/year

UPDATE 10/15/25: Now that Your Health Idaho's has gone LIVE for 2026 Open Enrollment, I've revised/updated both the table and graph below to include the actual results for the four households above.

There's several caveats:

-

The average Benchmark Silver ACA premiums are based on 2026 levels.

-

Benchmark Silver premiums vary widely depending on where you live & other factors. For Idaho I'm using Boise.

-

In some states, children under 19 are eligible for CHIP or Children's Medicaid at a significantly higher household income level. This can cause a sudden jump in full-price premiums as the household income moves over that eligibility threshold.

-

These analyses assume that the enrollees are enrolled in the benchmark Silver plan this year (Moda Select Silver 4000 w/Vision) and that they remain in the same plan in 2026 (this is important because the benchmark plan often changes from year to year).

-

The original version of this analysis included a 4.3% increase in the unsubsidized benchmark plan premium based on a projection by the Congressional Budget Office. However, that was a national average projection which didn’t take into account other factors like increased utilization, medical inflation and so on. This updated version assumes the actual 2026 Idaho rate filings.

-

The original version of this analysis assumed that the Applicable Percentage Table would revert back to the pre-2021 levels. However, the Trump Administration recently modified the formula used to calculate this which means that ACA subsidies will be even less generous starting in 2026.

With all that understood, let's take a look:

-

A single 50-yr old earning $30,000/yr would go from paying $50 in premiums to $158/month...over 3x as much as they're paying this year.

-

A single parent earning $40,000/year would go from paying $61/month to $205/month...over 3.3x as much.

-

A family of four earning $60,000/year would see their premiums jump from $85/month to $302/month...over 3.5 as much.

-

A 63-yr old couple earning $90,000/yr would go from paying $639/mo to $2,303/mo...3.6x as much as they're paying today for the same policy.

There’s still a chance that Congressional Republicans might agree to extend the improved subsidies, but...

- The odds of it happening are slim

- They would likely only agree to a watered-down version and/or would include poison pill demands of Democrats in return

- Even if they do so, the actual rate hikes will likely already be baked in for 2026 (which would still leave unsubsidized enrollees stuck with the 10%+ rate hikes)

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.